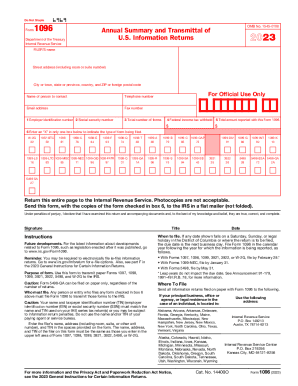

What is IRS form 1096, and who should file it?

Internal Revenue Service (IRS) Form 1096 functions as a cover sheet for a specific range of records. If you submit 1099, 1097, 1098, 3921, 3922, 5498, 8935, and W-2G forms, you need to fill out a separate 1096 template for each of them.

What information do you need when you fill out the 1096 template?

Filling out the Annual Summary and Transmittal of U.S. Information Returns does not require much information. You need to have the filer's name, address, contact person's name and address, EIN or SSN, and know what and how many documents you submit and their total tax amount.

How do I fill out an IRS Form 1096 in 2025?

Follow the guidelines below to complete the IRS form 1096 template online:

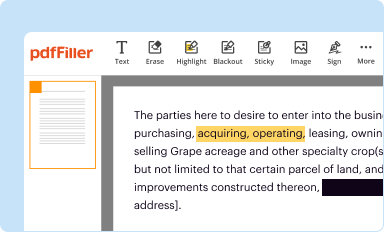

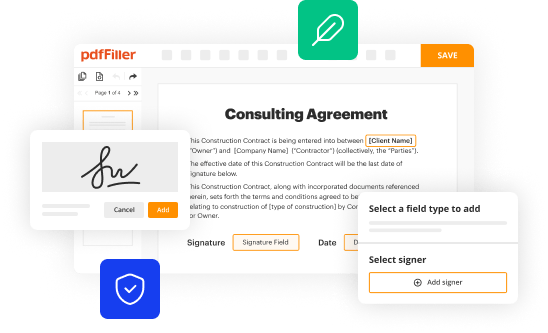

- Click Get Form to open it in an editor.

- Review the document.

- Click the first fillable field to start adding your information.

- Supply your company's name and address, as well as the name and address of your contact person.

- Include either an EIN or Social Security Number.

- Include the total number of documents that you are sending to the IRS in Box 3.

- In Box 4, enter the total amount of federal income tax withheld on all indicated forms.

- In Box 5, enter the total amount of reported payments on all forms you are including.

- In Box 6, select the appropriate boxes to specify the document types you are submitting.

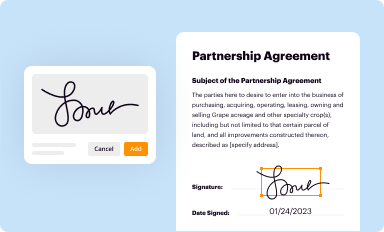

- Click Done to save changes and access the exporting menu where you can print, download, or send your template.

Is the IRS form 1096 accompanied by other documents?

The answer depends on which one of the thirty information records listed on a 1096 template you are submitting to the Internal Revenue Service and to recipients. Filers are financial institutions, corporate or small business payroll, educational institutions, government units, insurance companies, brokers, mortgage lenders, real estate agent closing sales, multiple homeowners, subsequent loan holders, multiple lenders, small businesses, corporations, casino, lottery, racetracks or other gambling operations.

A 1096 template must accompany all PAPER filed Forms, 1097, 1098, 1099, 3921, 3922, 5498, or W-2G. You must group the forms by their number. Attach a separate IRS form 1096 to each group of records.

When is the IRS Form 1096 due?

Filing dates for IRS Form 1096 vary. It is important to check the deadline for the specific documents that you are submitting. Most of the records that an IRS Form 1096 accompanies are to be submitting by paper by the last business day in February. These inlcude Forms 1097, 1098, 1099, 3921, 3922, or W-2G alongside the IRS form 1096.

In May, you need to submit the IRS form 1096 with Forms 5498, 5498-ESA, and 5498-SA.

You can file by the next business day if the regular due date falls on a Saturday, Sunday, or a legal holiday. Remember to meet deadlines for submitting each form.

Is there a penalty if I don't attach an IRS form 1096 to my forms?

Yes. The penalty depends on how late you submit the IRS form 1096. If you file late, but within 30 days of the due date, the penalty is $50. Then, it goes up and stays at $100. If you don't file the document until August 1, the penalty grows to $260.

Where do I send the IRS form 1096?

Remember that if you file 250 or more copies, you must file them electronically.

If you file a paper copy, you need to order a scannable 1096 template from the Internal Revenue Service. To do so, go to the IRS ordering page, select Online Ordering for Information Returns and Employer Returns, and enter the number of templates you want to receive. Information returns are sent by the issuer to recipients, but 1096s are not sent to the recipients; rather, they are only sent to the Internal Revenue Service.

The Internal Revenue Service accepts 1096s in three offices. The address you select depends on your principal business residence. You can find the required information on the IRS website, specifically on the “Where To File Form 1096” page.